Truly support

independent journalism

Our mission is to provide unbiased, fact-based reporting that holds the powerful to account and exposes the truth.

Whether it's $5 or $50, every contribution counts.

Support us in offering journalism without agenda.

The Bank of England is set to announce its decision on whether to cut interest rates later today, with experts saying the decision is “on the brink”.

Some analysts expect the UK could see a small reduction in the base rate from 5.25 per cent to 5 per cent. Borrowing costs are at their highest level in 16 years, with the current rate unchanged since August last year.

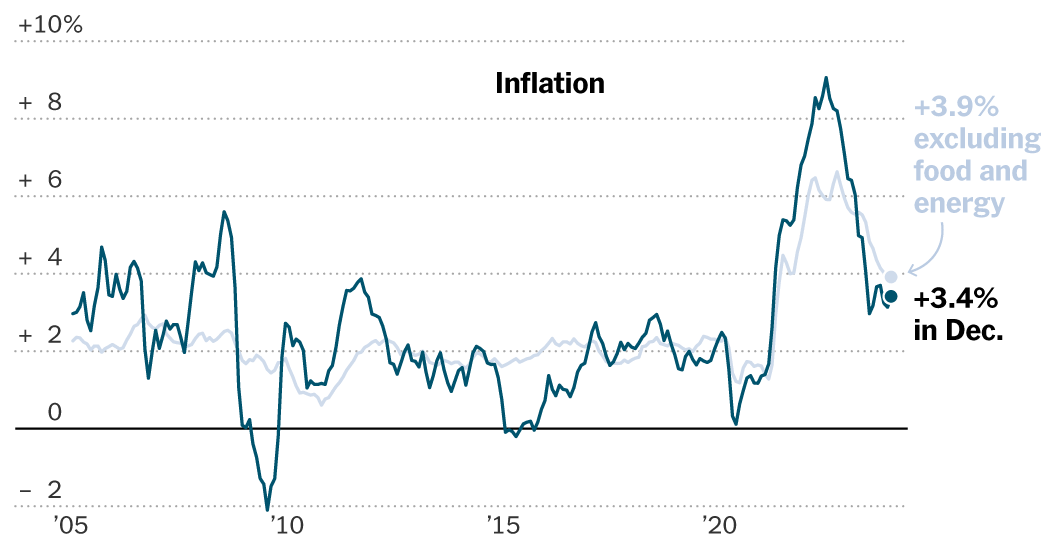

The bank has maintained this rate so far in response to the rise in prices the UK has experienced in the wake of the Covid pandemic. Inflation hit an all-time high of 11.1 percent in October 2022 as the cost of living crisis has gripped British households for the past two years.

However, inflation returned to the Bank's target of 2% in May and remained stable at that level in June. This does not mean that prices are falling to pre-pandemic levels, but they are now rising at a slower pace.

Some experts hope that a return to a normal level of inflation could prompt the Bank to cut interest rates. They say that raising interest rates is intended to help curb inflation, but it also hits savings and mortgages.

But what exactly is the relationship between interest rates and inflation, and how does it affect mortgage rates?

Interest rates and inflation

The Bank of England uses interest rates as a tool to help control inflation.

As of July 2024, rates are currently at 5.25 percent, a level that Bank policymakers have maintained during the past six votes.

They were raised to this level to make it more expensive for individuals and businesses to borrow money, which influenced their demand for goods.

This makes it difficult for companies to continue raising prices at the same pace, contributing to the slowdown in inflation.

Rate-setters at the Bank watch the headline rate of inflation, but also keep a close eye on specific areas, such as services inflation, which has been particularly sticky at 5.7 percent in May.

Interest rates and mortgages

Mortgage rates are agreed with individual borrowers and lenders, and are generally higher than the Bank of England base rate, although some types of mortgages track movements of the Bank of England base rate.

Most people who have a mortgage will be affected in some way by a change in interest rates. The exact way will depend on the type of mortgage, among other factors.

Discounted, standard variable rate (SVR) and continuous variable rate mortgages

The single interest rate is set by the mortgage lender and generally follows movements in the Bank of England's base interest rate.

When interest rates rise, lenders are likely to pass this on to customers.

Variable rate mortgages are another type of variable rate mortgage, but they are tied to the Bank of England base rate. Rates can increase more on a variable rate mortgage than on a non-variable rate mortgage.

For example, a variable rate mortgage could be set at 1% above the base interest rate. In December 2021, this would mean that the mortgage interest rate would be 1.1%. However, in June 2023 it would have risen to 6%.

Fixed rate mortgage

Fixed-rate mortgage rates will remain the same for the period of time agreed upon between the borrower and lender, regardless of whether interest rates go up or down.

Once the fixed term ends, borrowers automatically move to the mortgage lender's single interest rate, which is affected by Bank of England rates.