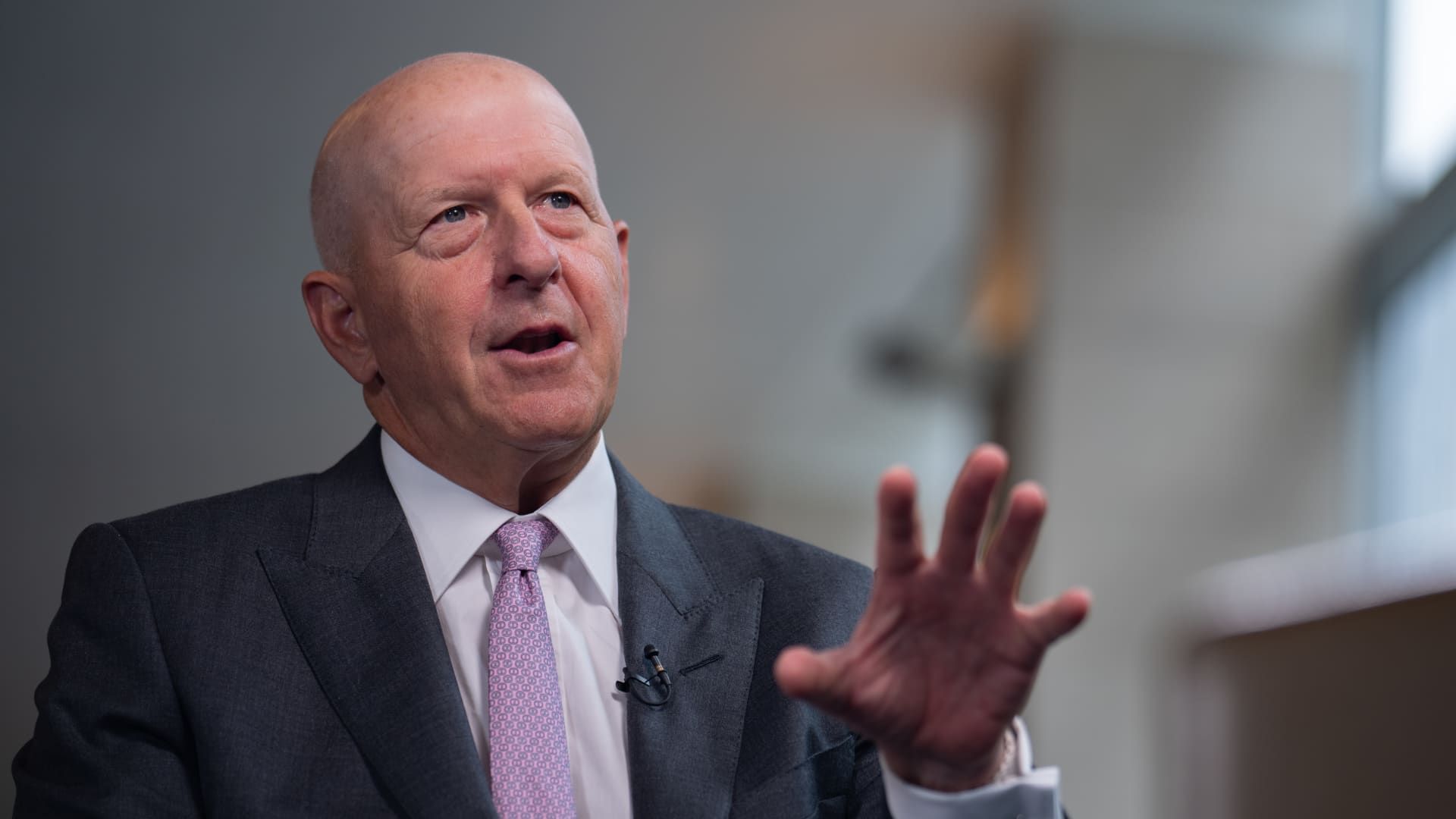

David Solomon, CEO of Goldman Sachs, during an interview for an episode of “The David Rubenstein Show: Peer-to-Peer Conversations” in New York on August 6, 2024.

Jeenah Moon | Bloomberg | Getty Images

Goldman Sachs will take a roughly $400 million pretax hit to its third-quarter results as the bank continues to shed its ailing consumer business.

Chief Executive David Solomon said on a conference call Monday that by shedding Goldman's GM card business, as well as a separate lending portfolio, the bank would see a revenue hit when it reports results next month.

This is the latest turbulence related to Solomon’s foray into consumer retail. In late 2022, Goldman began to pivot away from its nascent consumer operations, initiating a series of writedowns related to the sale of parts of the business. Goldman’s credit card business, particularly its Apple Card, enabled rapid growth in retail lending but also led to losses and friction with regulators.

Instead, Goldman is focusing on asset and wealth management to help drive growth. The bank was in talks to sell the GM Card platform to BarclaysAs reported by The Wall Street Journal in April.

Solomon also said Monday that trading revenue for the quarter was on track to decline 10% due to a tough year-over-year comparison and difficult trading conditions in August for fixed-income markets.