Goldman Sachs on Tuesday reported its second straight quarter of stable profits, a return to form for the bank, which has struggled with management missteps that tarnished its once untouchable reputation on Wall Street.

The bank's fourth-quarter profit of $2 billion was about the same as what it earned in the third quarter, but that was a sign of achievement. Until recently, the bank had been dogged by a series of losses from its unsuccessful attempt at consumer banking and its souring real estate portfolio, among other problems.

Contributing to the bottom line: Goldman cut 3,200 employees over the course of 2023, a 7 percent cut to its workforce. It is on a long list of multinational companies that have laid off staff in recent months.

Goldman shares rose less than 1 percent, bringing the gain to about 9 percent over the past year. But the stock is still below its 2021 high, and the bank's annual profit of $8.5 billion last year was the lowest since 2019.

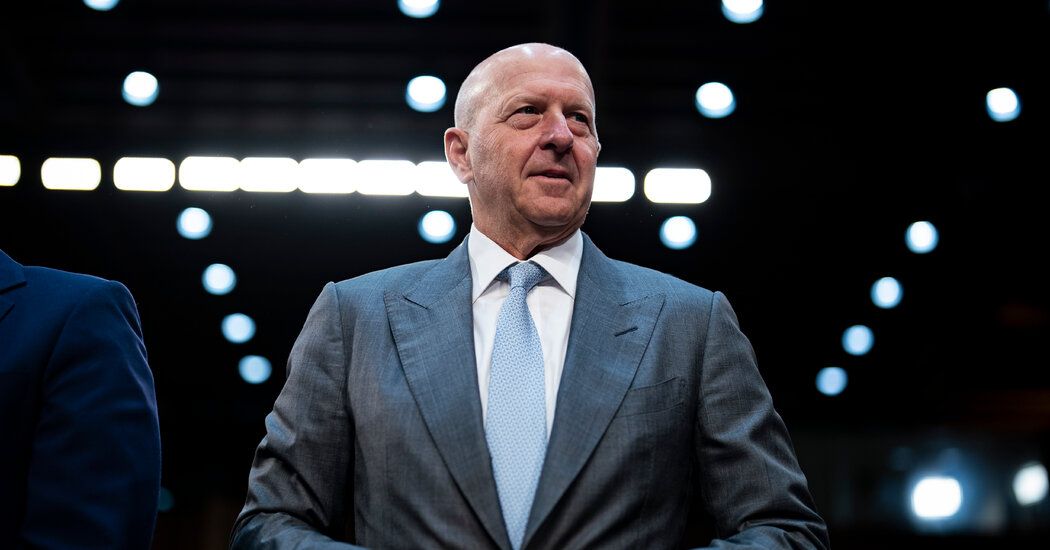

Goldman Chief Executive David M. Solomon credited the bank's “clear and simplified” strategy with helping right the ship in recent months. “It feels better,” he told analysts.

Mr. Solomon is right that his organization is charting a different course. The bank has struggled to scale back its consumer ambitions and is instead relying again on its traditional work of facilitating trading for deep-pocketed clients, charging fees for advising on mergers, arranging bond issues and the like.

That strategy leaves its quarterly profits more closely tied to the whims of financial markets; In fact, the bank earned significantly less last year than it will in 2022, thanks in part to an industry-wide slowdown in corporate advisory work, but it also means the bank is looking more like the venerable Goldman Sachs of yesteryear.

Solomon has also pinned hopes on an expansion of the bank's asset management operation, a relatively low-margin but stable business.

Last week, some of Goldman's rivals reported a series of mixed quarterly results, clouded in part by steep government-mandated costs to replenish a federal insurance fund depleted by a crisis at midsize banks last year. (Goldman invested $529 million in the fund last quarter.)

Still, JPMorgan Chase, Bank of America and Wells Fargo generated billions of dollars in profits, beating analysts' expectations.

Given its recent struggles, Goldman can take solace in the fact that the industry's new laggards appear to be Citigroup, whose headquarters are just a few blocks north of Goldman in Lower Manhattan, and a former Goldman rival, Morgan Stanley.

Citi last week revealed a big loss and plans to cut about 10 percent of its workforce, or about 20,000 people, as part of a major restructuring.

Morgan Stanley, which last week agreed to pay $249 million to resolve investigations into its trading arm, on Tuesday reported disappointing earnings that sent shares down 4 percent, a heartwarming welcome for its new chief executive.