© Reuters. The Goldman Sachs logo is seen on the trading floor of the New York Stock Exchange (NYSE) in New York City, New York, U.S., November 17, 2021. REUTERS/Andrew Kelly/Photo archive

By Elizabeth Howcroft

LONDON (Reuters) -The recent rise in cryptocurrency prices has been driven by retail investors, but institutions are starting to join in, Goldman Sachs head of digital assets Mathew McDermott said on Tuesday.

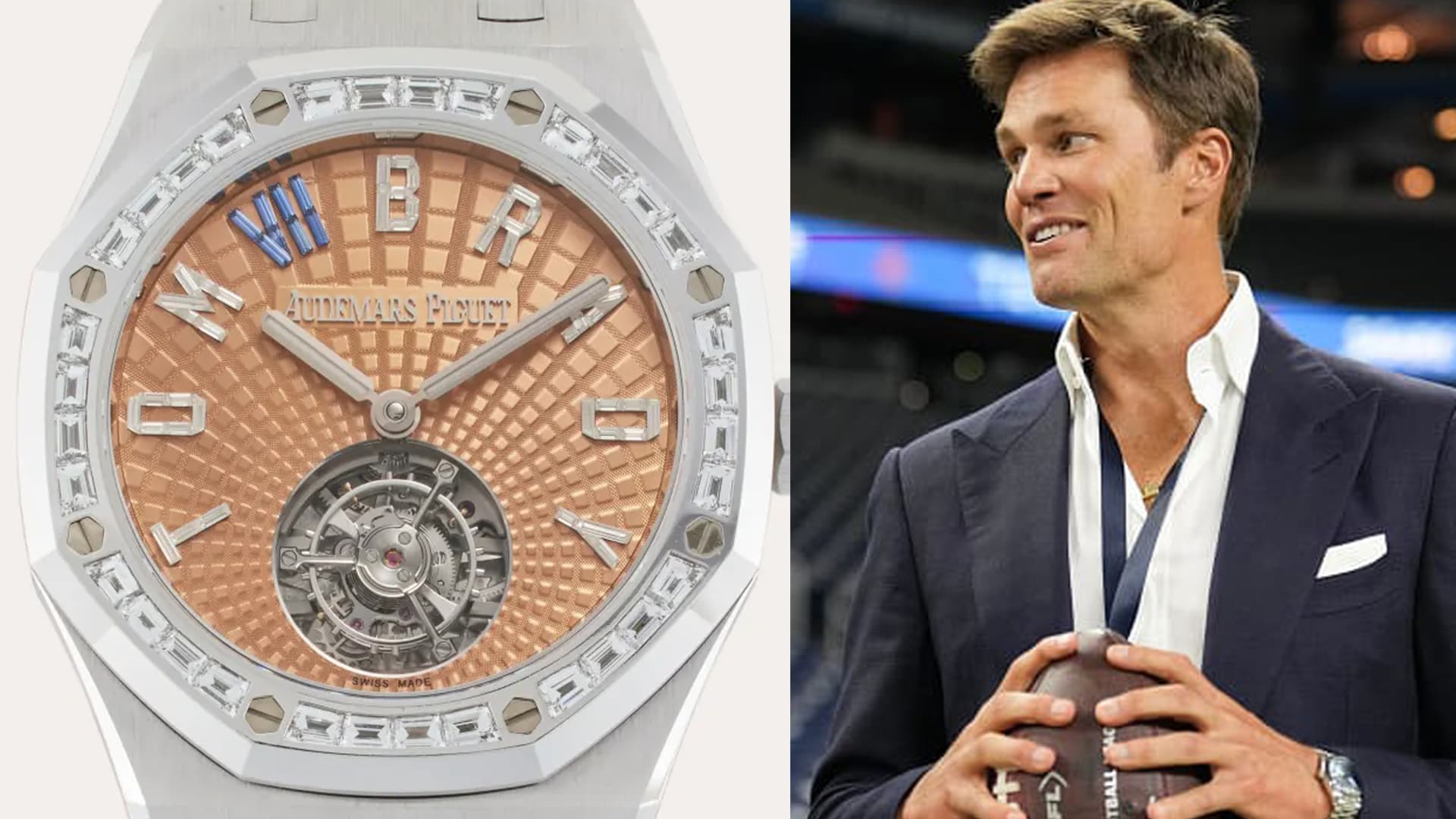

The largest cryptocurrency, hit an all-time high of $73,794 last week and has gained 50% so far this year, dragging down the prices of other cryptocurrencies with it.

“The price action () has still been primarily driven by retailers. But it's institutions that we've started to see coming in,” McDermott said, speaking at the Digital Asset Summit (DAS) conference in London. “Now you really see that the appetite has transformed.”

Goldman Sachs launched a cryptocurrency trading desk in 2021 and continues to build on it, McDermott said.

“Last year was difficult, but just getting into this year we have seen a big change not only in terms of types of customers but also in terms of volumes,” he said.

No one knows for sure what is driving bitcoin's latest gains, although analysts note that billions of dollars have flowed into U.S. spot bitcoin ETFs that launched this year. McDermott said ETFs caused a “psychological shift.”

Bitcoin's rally has cooled slightly in recent days, along with other riskier assets, after a series of US data releases suggested the Federal Reserve may not cut interest rates this year as much as previously expected. .

BANKRUPTCY CLAIMS

Cryptocurrencies surged throughout 2020 and 2021, as ultra-low interest rates helped fuel speculative investment.

The pandemic-era boom was followed by a sharp decline in 2022, when a series of bankruptcies and failures at the largest cryptocurrency companies, including FTX, wiped $2 trillion from the cryptocurrency market and left millions of investors out of business. money.

McDermott also said the bank had been “looking at the bankruptcy claims and some of the other investment opportunities,” without elaborating.

Regulators have long warned that bitcoin is a high-risk asset, with limited real-world use cases.

The Goldman executive said there is currently “a certain leverage component in the system,” but not the same “hyperbole” as during 2021 and 2022.

Several banks, including Goldman Sachs, have expressed interest in the blockchain technology underlying cryptocurrencies, saying it could be used to trade assets other than cryptocurrencies.

There have been pilot projects to issue blockchain-based versions of traditional financial assets, such as bonds, but there is no routine issuance or liquid secondary market.

“I think over time we will start to see more asset classes tokenized and they will actually gain some scale, but maybe that will be a year or two away,” McDermott said.