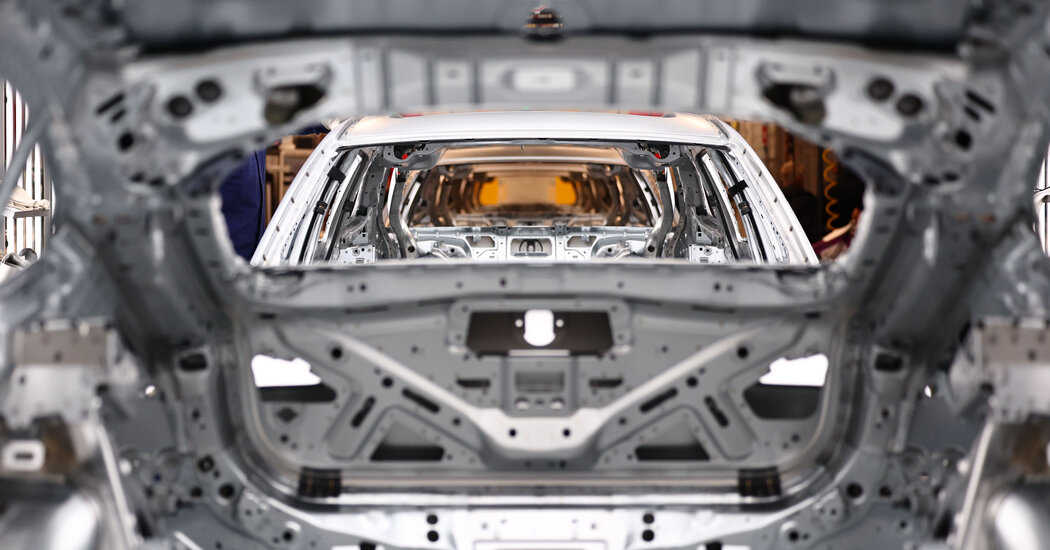

A Ford Mustang Mach-E GT compact sport utility vehicle during the 2022 New York International Auto Show in New York on April 14, 2022.

Michael Nagle | Bloomberg | fake images

DETROIT— Ford engine is rethinking its electric vehicle strategies, including “reevaluating” the need for vertical integration of batteries, CEO Jim Farley said Tuesday.

The Detroit automaker previously confirmed plans to delay or cut $12 billion in spending on all-electric vehicles, but the comments made Tuesday are the most detailed about Ford's changing plans for electric vehicles, sales of which are growing at a slower rate than expected.

“One of the things we're taking advantage of by taking some time delays is rationalizing the level and timing of our battery capacity to meet demand and actually reassessing the vertical integration that we rely on and going for new chemistries.” and capabilities.,” Farley said during the automaker's fourth-quarter earnings conference call.

Farley reiterated that the company still believes electric vehicles will grow, but noted that widespread adoption by mass-market consumers will not occur until costs are more in line with those of traditional vehicles. Electric vehicles are typically thousands of dollars more expensive than their gasoline-powered counterparts.

Ford Chief Financial Officer John Lawler said that in addition to reevaluating vertical integration in new battery chemistries, the company is looking to adjust installed production capacity to meet demand and potentially delay next-generation electric vehicles to “ensure that meet our profitability criteria. given the new market reality.”

The company's electric vehicle business, known as Model e, lost $4.7 billion last year, including $1.57 billion during the fourth quarter of 2023, offset by gains in the company's fleet and traditional car units. internal combustion engines. Both companies earned more than $7 billion each last year.

Lawler said Tuesday that the unit will have to stand on its own “sooner rather than later.”

He also said the company is hitting a target for its electric vehicle unit that calls for an 8% margin by 2026. The company had already set a target of two million vehicles sold annually at that time.

As Ford steps back and reassesses the electric vehicle business, it intends to lean on sales of hybrid vehicles, specifically pickup trucks. The company expects its hybrid sales to increase 40% this year. Sold 133,743 hybrid vehicles in the US in 2023.

Don't miss these CNBC PRO stories: