Investing.com — Bitcoin price fell on Tuesday as a weekend rally petered out amid growing uncertainty over the U.S. presidential race, with traders now looking ahead to Republican presidential candidate Donald Trump's next speech.

The world's No. 2 token, Ether, also retreated, recording few positive transactions even as the Securities and Exchange Commission approved six Ether spot ETFs to begin trading later in the day.

Over the past 24 hours, the cryptocurrency's price fell 2.2% to $66,419.2 as of 01:24 ET (05:24 GMT). The token had risen as high as $69,000 over the weekend but stalled on Monday.

fell 2.2% to $3,432.21 and the token is expected to see some selling as major ETF issuers prepare to launch their spot offerings.

Bitcoin rally stalls as Trump speech awaited

The world's largest cryptocurrency extended its losses into a second session as the weekend rally stalled. The weekend rally was mainly due to lower trading volumes.

Still, Bitcoin held on to some gains over the past week as speculation about a Trump presidency raised hopes for a friendlier regulatory environment.

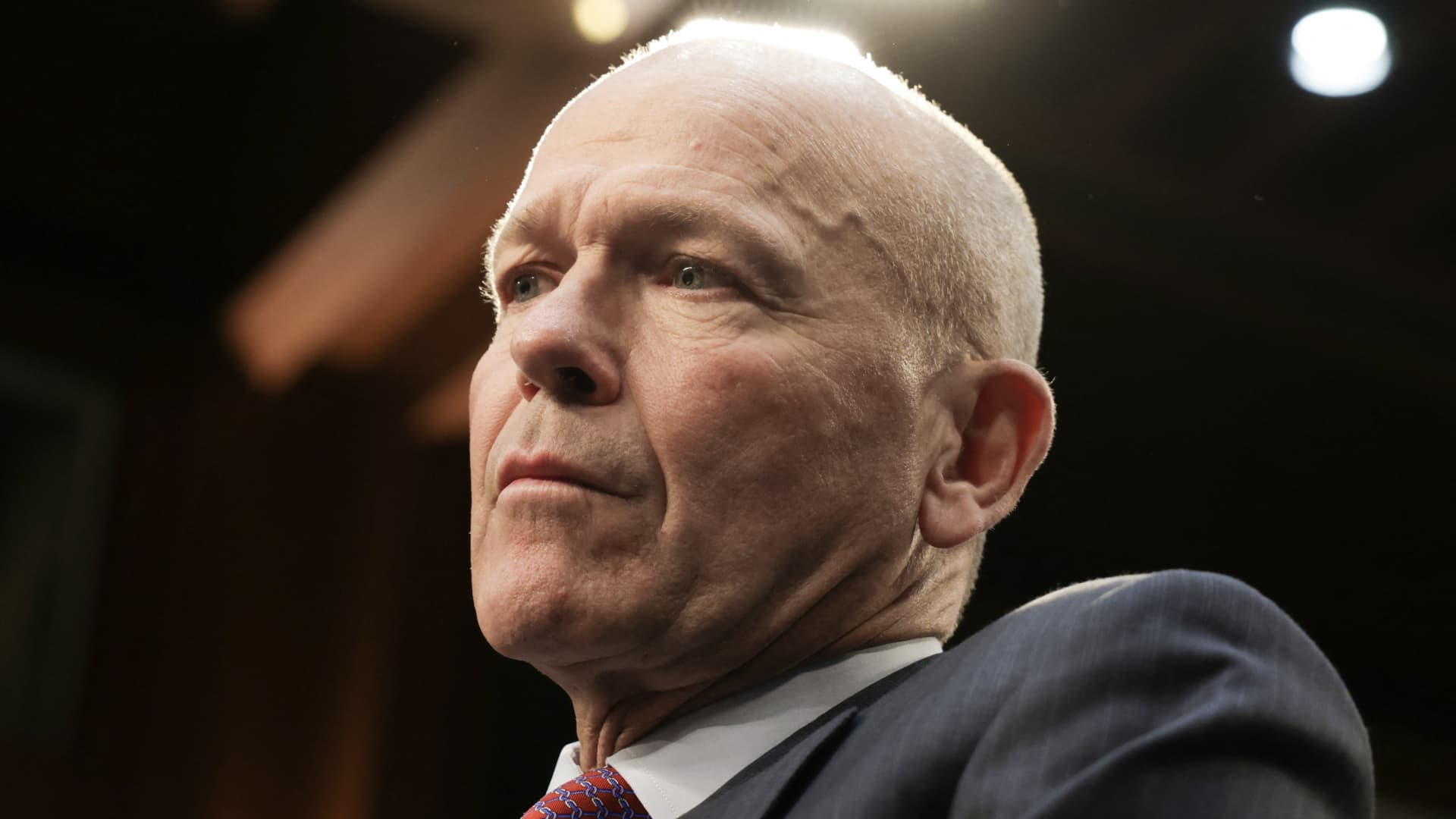

Trump is scheduled to speak at the Bitcoin Conference in Nashville this Saturday. The Republican candidate has maintained a pro-cryptocurrency stance during the recent campaign and his campaign also accepts cryptocurrency donations.

But uncertainty about Trump's prospects increased after President Joe Biden dropped out of the 2024 election and instead endorsed Vice President Kamala Harris as the Democratic presidential nominee.

Harris is believed to have received enough support from Democratic delegates to be chosen as the presidential candidate, but she still needs to be officially nominated.

According to CBS and HarrisX polling data from last week, Trump was leading Biden and Harris in the polls, but it was unclear how Biden's withdrawal would play out in the polls, given that some analysts had expected Harris to perform better as a presidential candidate against Trump.

Cryptocurrency price today: Ether ETF set to launch, altcoins struggling

Ether fell after the SEC approved six different applications for a spot ETF on US markets, which will begin trading on Tuesday.

The launch comes nearly six months after spot Bitcoin ETFs were approved for US markets. While the launch had provided an initial boost to Bitcoin, taking it to all-time highs in March, the token has since teetered around $60,000 for the most part, while trading volumes in the ETFs also declined.

Additionally, Ether may face some selling pressure as Ether trust operator Grayscale, which is set to convert the trust into a spot ETF, moved $1 billion of the token to exchanges.

Other altcoins followed Bitcoin and Ether's losses, falling 2.8% and 3.3% respectively while gaining 1%.

Among meme tokens, they lost 5%, while they fell 3.8%.