disneyESPN is at a crossroads.

For more than 40 years, the world's largest sports network has increased its annual revenue by increasing cable subscription fees. ESPN first charged pay-TV distributors less than $1 per month per subscriber in the 1980s. In 2023, ESPN's monthly carriage fee was $9.42 per subscriber, according to data from S&P Global Market Intelligence.

That business model is eroding. Since 2013, tens of millions of Americans have canceled their cable TV subscriptions., raising questions about the future of ESPN in an increasingly fragmented media landscape. CNBC spoke with several current and former Disney and ESPN executives about the network's path forward as part of the digital documentary “ESPN's Fight for Dominance.”

ESPN reported that domestic and international revenue grew just 1% to $4.4 billion in its most recent fiscal quarter. The network can no longer rely on price increases to make up the difference as the number of cable customers declines.

The company has a new two-part transmission plan to revitalize growth. First, this fall, Disney will make ESPN available for the first time outside of the traditional cable TV package as part of a joint venture with Warner Bros. Discovery and Fox. The service, which is not yet priced, will be aimed at non-cable customers who want to watch sports but don't want to pay $80 or $100 a month for a full network package.

Second, in the fall of 2025 ESPN will launch its flagship streaming service that will include everything ESPN has to offer, both live and on-demand. It will include unprecedented customization and will interact with ESPN Bet, the company's licensed online sportsbook and fantasy sports to cater to younger fans. The product will go far beyond ESPN+, which exists as a $10.99 streaming service that doesn't include ESPN's more expensive programming, like all of “Monday Night Football.”

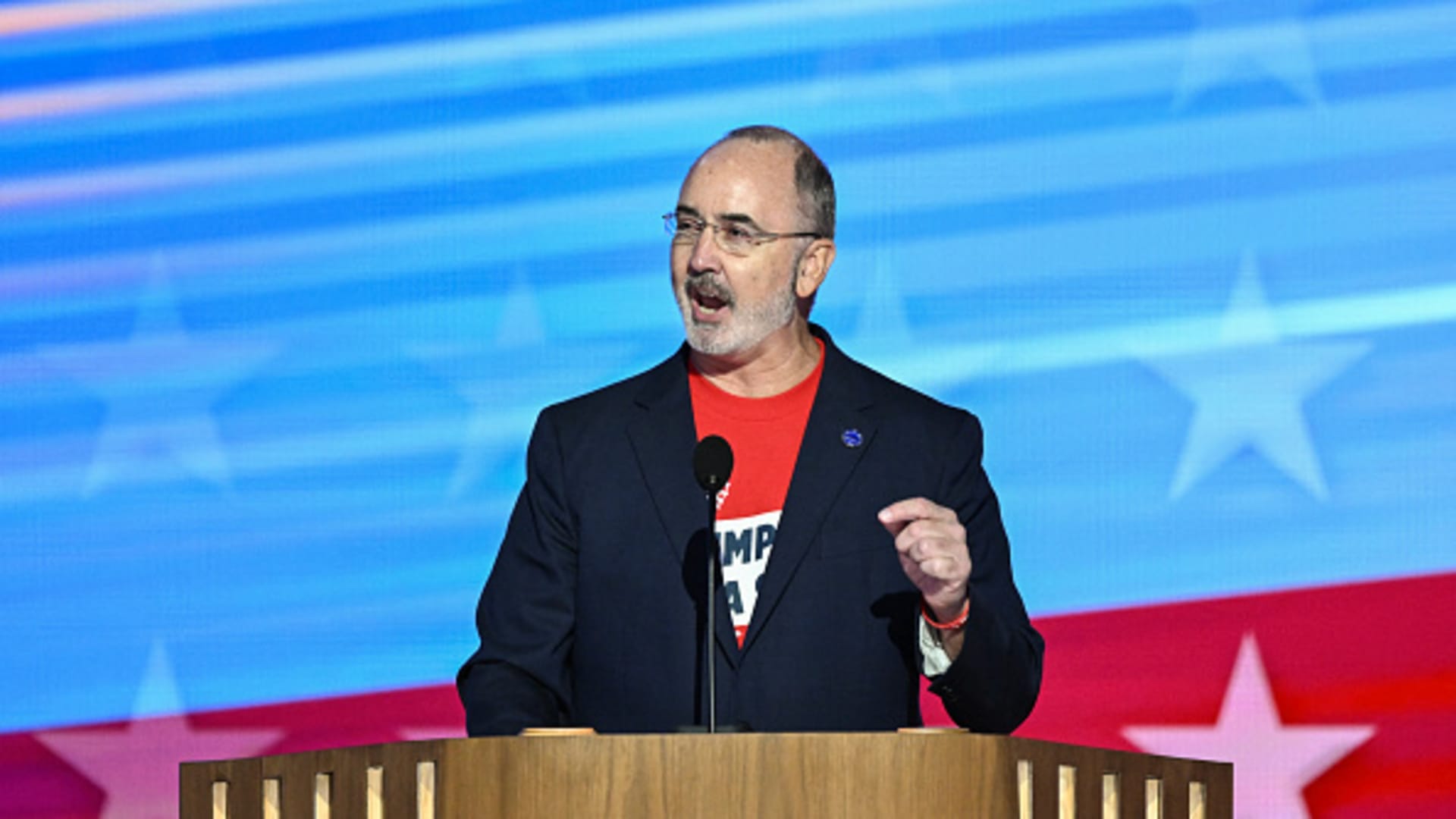

Jimmy Pitaro, president of ESPN

Photography by Steve Zak | CineMagia | fake images

“The industry is in a transition phase right now,” ESPN president Jimmy Pitaro said in an interview as part of the CNBC documentary.

“We are seeing declines in the traditional ecosystem, the cable and satellite universe,” Pitaro said. “There is a transition to digital. That is by far the most important component of our future.”

Pitaro and programming chief Roz Durant defended ESPN's growth plan to CNBC, while former Disney and ESPN executives Bob Chapek, John Skipper and Mark Shapiro noted that the so-called global leader in sports faces multiple potential obstacles. as he charts his path forward.

Watch the documentary to get the full story.