Electric vehicle maker Rivian missed Wall Street's revenue expectations on Thursday, and sales were lower than expected in the third quarter.

The Irvine-based company reported revenue of $874 million in the three months ended Sept. 30, below the $992 million projected by analysts, according to FactSet. The company posted revenue of $1.3 billion during the same period a year ago.

In a letter to shareholders, Rivian attributed the revenue decline to a production disruption and “a more challenging consumer environment.”

Rivian faces several obstacles, including supply chain issues, safety concerns and lower demand for electric vehicles from consumers concerned about cost and convenient charging options.

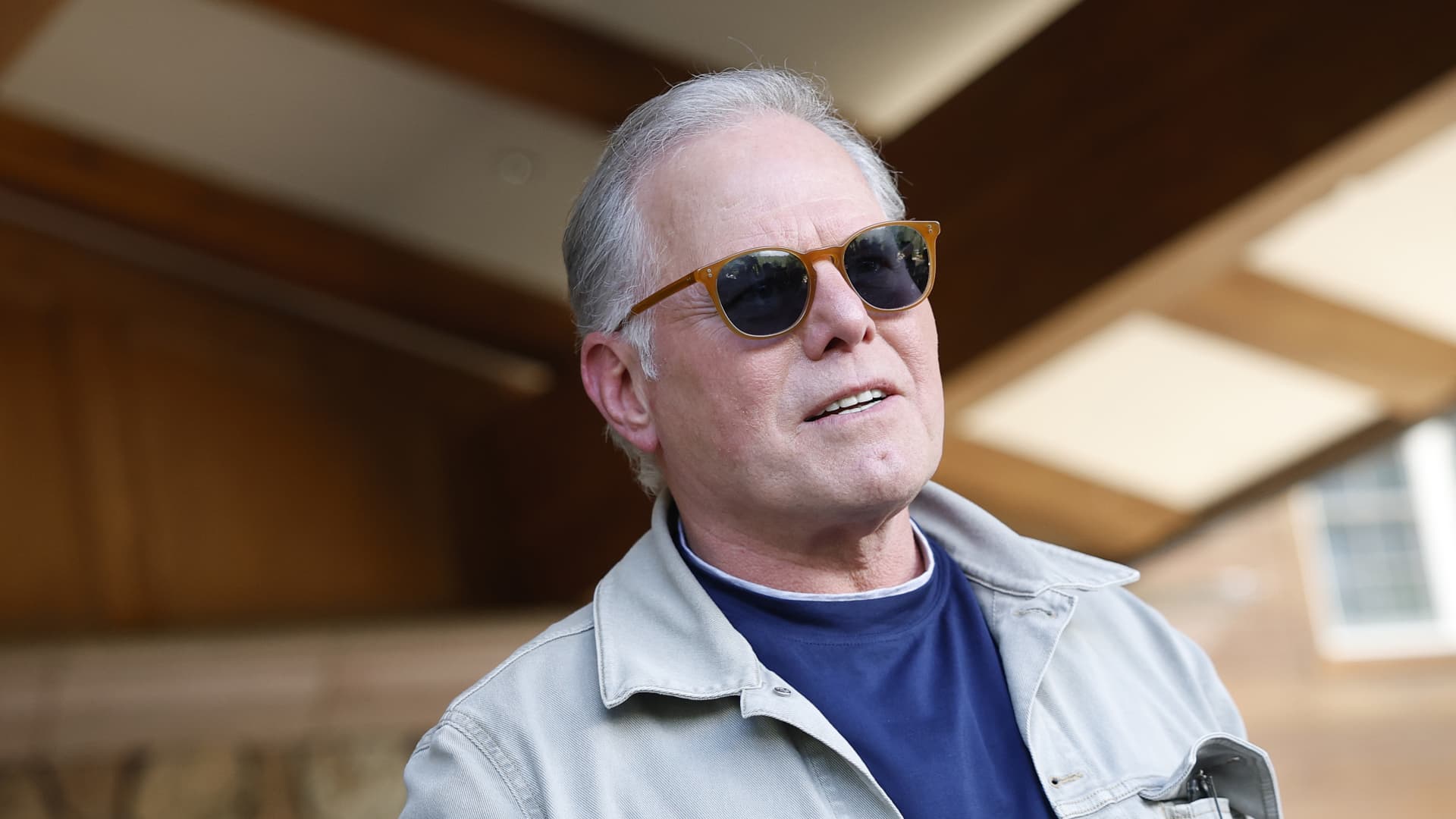

RJ Scaringe, the company's founder and CEO, said on a call with analysts that it has been a “difficult quarter” for Rivian due to supply chain hiccups and fixing them has been one of the company's top priorities.

“We are working very, very hard to address that,” Scaringe said, adding that the company sees the challenge as a “short-term issue.”

Automakers are also bracing for greater uncertainty after Republican Donald Trump won the 2024 presidential election this week, ensuring his return to the White House. Trump, while softening his criticism of electric vehicles after Tesla CEO Elon Musk endorsed him, has considered ending a $7,500 federal tax credit for the purchase of new electric vehicles.

Consumers who lease Rivian vehicles can take advantage of that tax credit, but there are also income requirements, so most of their customers don't qualify. Since Trump could impose more tariffs on imported goods, the company has focused on finding suppliers that are not subject to large tariffs, Scaringe said.

“There are a lot of political elements at play here and we are watching them very closely,” he said on the call. Manufacturers are watching how tariffs could affect the price of raw materials.

The company reported a net loss of $1.1 billion, or $1.08 per share, in the third quarter, compared with a loss of $1.4 billion during the same period last year.

Rivian made its public debut in 2021 and its stock price fell 42% in the last year. Rivian shares closed Thursday at $10.04, up 3.35%.

The company's stock price took a hit last month when the startup missed delivery expectations for the third quarter and reduced its production forecast, reportedly due to a lack of communication with its copper coil supplier. Rivian produced 13,157 vehicles at its manufacturing plant in Normal, Illinois, and delivered 10,018 vehicles in the third quarter.

As the company tried to find a path to profitability, it signed high-profile deals with partners including Amazon and German automaker Volkswagen Group, which said it would invest $5 billion in Rivian this year.

Known for their stylish electric adventure vehicles, Rivian's trucks and sport utility vehicles stand out on the road. However, for some consumers, vehicle prices are too high. The company's R1S SUV starts at $75,900 and the R1T pickup truck starts at $69,900. Rivian plans to launch a cheaper, more compact electric SUV, known as the R2, in 2026.

Rivian said Thursday that it signed a deal with LG Energy Solution to provide cylindrical battery cells for the R2.

The company plans to close its joint venture with Volkswagen in the fourth quarter.