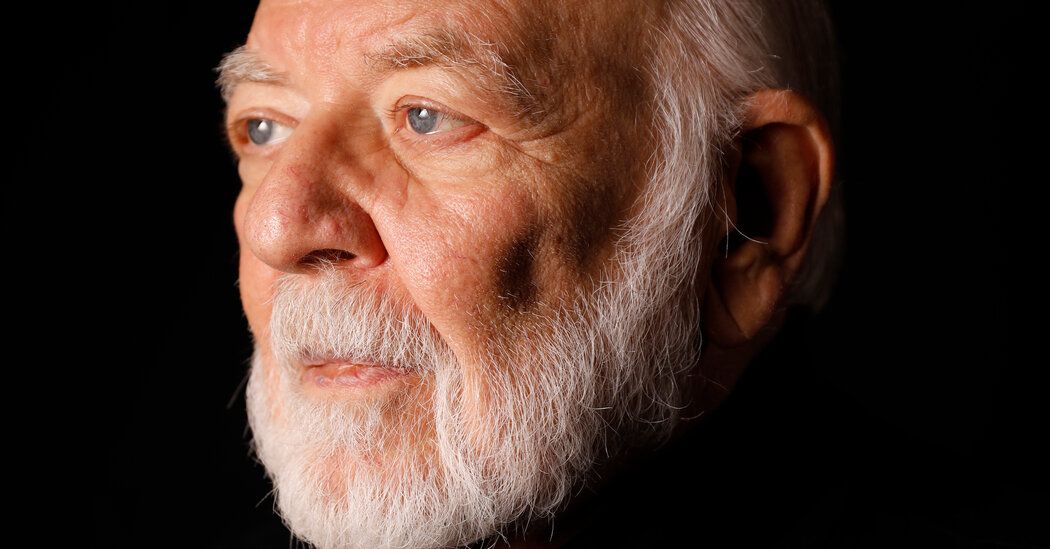

Throughout his 54 years as a financial analyst, Richard X. Bove perfected the art of commanding attention.

Through thousands of newspaper interviews, cable news appearances and radio segments, Bove turned what can be a boring and unremarkable career into a more attention-grabbing one. By intervening in the economy and the inner workings of Wall Street, he often bucked conventional wisdom and made enemies along the way. According to his own recollection, he never turned down a media request; American Banker once called him “the most cited banking analyst in the country.”

Last week, just hours after completing an announcement on Bloomberg Television, the 83-year-old announced his retirement. He took that weekend off and then took it back. In an interview with The New York Times, Bove (pronounced “boe-VAY”), who goes by Dick, shared a bleak outlook on the American economy and his former profession.

“The dollar is over as the world's reserve currency,” Bove said matter-of-factly, sitting in an armchair outside his headquarters just north of Tampa, from where he predicted China will overtake the U.S. economy. No other analyst will say the same because they are, as he put it, “monks who pray to money,” and they are not willing to talk about the conventional financial system that employs them.

Many analysts are rewarded for presenting unique but inconsequential and “arcane” ideas, he said, peppering their criticism with profanities. Bove worked at 17 brokerage firms during his career.

As he spoke, a technician was trying to restore his home Internet connection after his last employer, boutique brokerage Odeon Capital, disconnected on his last day.

Bove, who began his career before ATMs were common, began appearing in the media in the late 1970s, when he was a construction industry analyst with pessimistic opinions about houses that didn't always give result.

He quickly moved into high finance, giving him a front-row seat to the savings and loan crisis that brought down more than a thousand banks in the 1980s and 1990s. He later recounted how the surviving banks made big bets. which would lead to the 2008 financial crisis and a series of new regulations.

Among Mr. Bove's most famous calls: identifying a “powder keg” in the housing market as early as 2005 (correct) and predicting that some major banks would recover quickly afterwards (incorrect). His 2013 book, “Guardians of Prosperity: Why America Needs Big Banks,” argued that crackdowns on the industry would hamper lending to small businesses.

He has now changed his mind about the primacy of American banks, particularly after last spring's regional banking crisis. He considers the offshoring of American manufacturing to be the main threat to the financial sector and the dollar, because “the people who make the goods elsewhere are acquiring increasing control of the means of production and, therefore, a increasing control of the world economy and, therefore, of the world economy. greater and greater control of money.”

Bove was fired twice from big companies, Dean Witter Reynolds and Raymond James, in the first case for being too optimistic about bank stocks. BankAtlantic, now defunct, unsuccessfully sued him over a critical 2008 research report.

The headline of a Times article about that episode called him “The Loneliest Analyst.” One way this remains true is that he supports cryptocurrency, an area that few financial analysts will touch, which he sees as a natural beneficiary of the falling dollar.

Many on Wall Street viewed Bove as a crank or an attention seeker, but many others listened. Among those paying attention was Jamie Dimon, CEO of JPMorgan Chase, whom Bove generally praises. Dimon, through a spokesman, said he had read Bove's work to the end and found it “enlightening.”

One who's clearly not a fan: Brian Moynihan, the head of Bank of America, who hasn't spoken to the analyst in a decade, ever since Bove visited the bank's Manhattan headquarters and told executives they were foolish to expand. its investment banking operation. (A bank spokesman said his head of investor relations did not remember the conversation.)

Mr. Bove now says he was wrong and feels funny that he wasn't invited back.

“Sometimes I've liked being a pain in the ass,” he said, pausing for effect. “A lot of the time.”

A native of Queens who never quite got rid of his New York accent despite spending 30 years in Florida, Bove attributes the longevity of his career to an independent streak that includes an unwillingness to read the work of any rival analyst. He readily admits that luck has also played a role, marveling at his good health despite not exercising regularly and having a tendency to drink premium tequila, neat.

He said he had earned more than $1 million a year, but otherwise had an average annual salary of $700,000. (The CEOs of the major banks he covered can be paid more than $30 million a year.) That helped him buy a number of timeshares and invest in a handful of mostly failed business ventures, including four now-closed pizzerias in the Tampa area.

Have you ever tried to make a cake?

“No, I never did,” he said. “That was the problem.”

Alain Delaquérière contributed to the research.