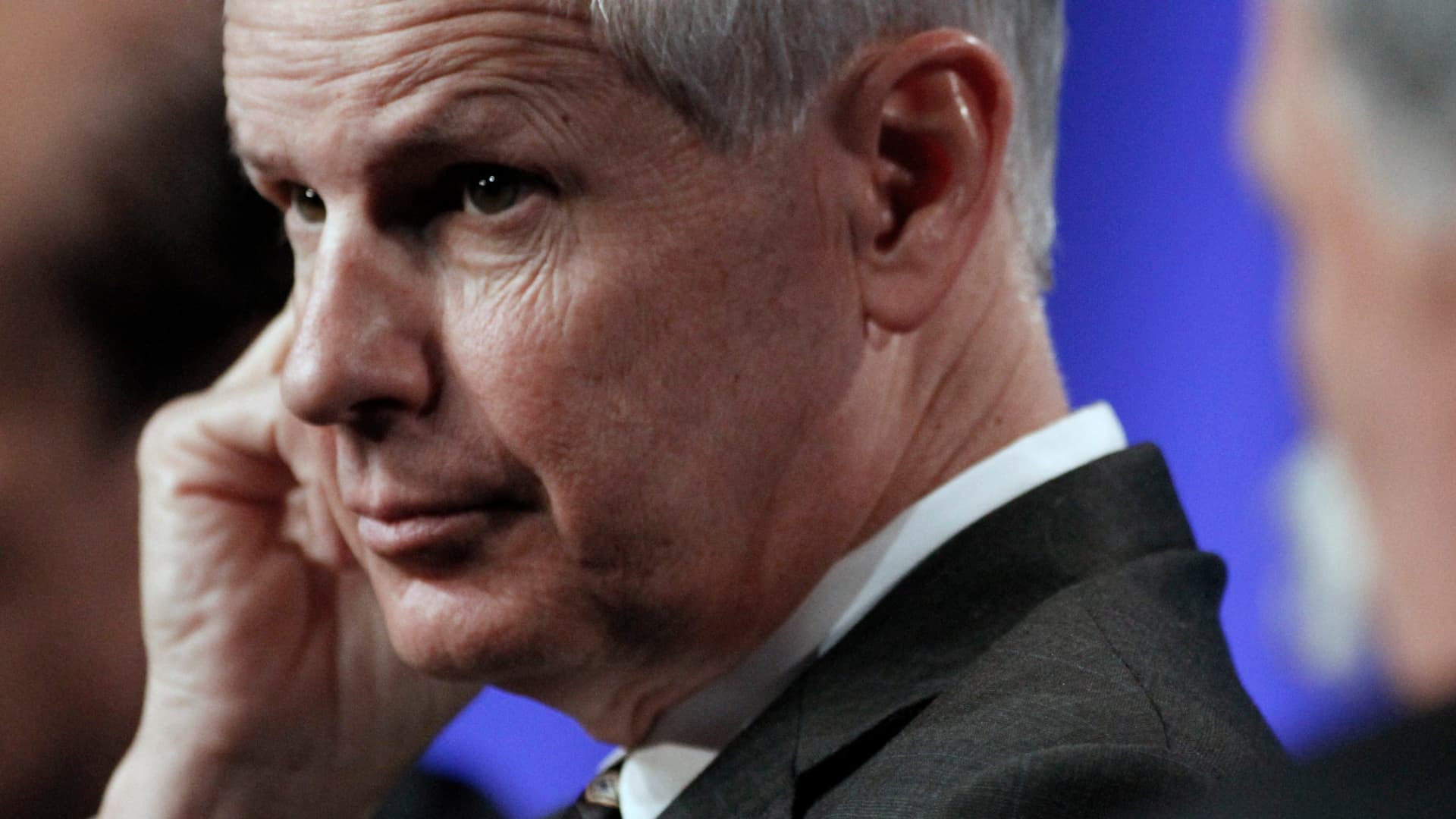

citi group Chief Executive Jane Fraser said Monday that consumer behavior has diverged as inflation of goods and services makes life more difficult for many Americans.

Fraser, who runs one of the largest credit card issuers in the United States, said he is seeing a “K-shaped consumer.” That means the wealthy continue to spend, while lower-income Americans have become more cautious about their consumption.

“Much of the spending growth has come in recent quarters with the wealthy customer,” Fraser told CNBC's Sara Eisen in an interview.

“We're seeing a much more cautious low-income consumer,” Fraser said. “They are feeling more pressure from the cost of living, which has been high and increasing for them. So even though there is employment for them, debt service levels are higher than before.”

The stock market has hinged on a single question this year: When will the Federal Reserve start cutting interest rates after a streak of 11 increases? Strong employment figures and persistent inflation in some categories have complicated the picture, pushing back expectations about when easing will begin. That means Americans must live with higher rates on credit card debt, auto loans and mortgages for longer.

“I think we, like everyone here, hope to see economic conditions that allow rates to come down sooner rather than later,” Fraser said.

“It's hard to get a soft landing,” the CEO added, using a term for when higher rates reduce inflation without triggering an economic recession. “We have hope, but it's always difficult to get one.”