While Elon Musk was touting plans to eventually build an army of Tesla robots in Silicon Valley this month, humanoid robots were already being produced and sold to consumers in China.

Chinese and American companies have begun a battle to build the best bots in the world. While it's still early, experts say China leads in the number of robots delivered to consumers, while the United States leads in the quality of robots demonstrated.

Musk danced with Tesla's Optimus robots at his company's shareholder meeting and outlined plans for a factory in Fremont that he said will one day have the capacity to build a million robots a year, which would sell for about $20,000 today. One of China's leading robotics companies, Unitree Robotics, already has a humanoid robot on the market that can walk, dance and perform basic tasks. Its cheapest version costs around $6,000.

The Tesla robot Optimus serves popcorn to guests at the Tesla Diner on the restaurant's opening day, July 21.

(Stephanie Breijo / Los Angeles Times)

While the inexpensive Unitree robot is much less sophisticated than Optimus, its early entry into the real-world market at an affordable price demonstrates China's advantage. The country has the parts, production facilities and labor needed to bring rapidly evolving robots to market quickly and cheaply, said PK Tseng, an analyst at technology consultancy TrendForce.

“The United States leads in technological innovation, while China excels in speed of implementation,” he said. “The real tipping point will come when humanoid robots move beyond research and development prototypes to be deployed on a large scale.”

The International Federation of Robotics, IFR, estimates that there are at least 80 humanoid robot companies in China, five times more than in the United States. A Morgan Stanley report on humanoid robots from earlier this year estimated that Chinese companies had more than twice as many robots filed as U.S. companies as of 2022, while Chinese organizations have filed for more than three times the number of patents using the word “humanoid” in the past five years.

At the forefront is Unitree, which went viral in January after its humanoid robots performed a live Chinese folk dance, marching rhythmically while throwing and twirling scarves. That model, which costs about $90,000, won the inaugural race at the inaugural Beijing Humanoid Robot Games in August, taking six and a half minutes to travel about a mile.

Students from the primary school affiliated with Hefei Normal School interact with the humanoid robot “Xiao An” after a science class on October 27 in Hefei, China's Anhui province.

(China News Service via Getty Images)

The company has become a Chinese tech darling and is preparing for an initial public offering with a reported valuation of up to $7 billion.

The ultimate goal of a general-purpose robot, one that can package products, perform household tasks and assist in surgical procedures, is still years away. Humanoid robots are not yet fully autonomous and are mainly purchased by hobbyists, research institutions or manufacturers. Hyundai Motor Group is deploying robots made by Boston Dynamics in its auto factories. In China, humanoid robots are also bought and rented for entertainment, to dance and perform at events.

According to TrendForce, the latest generation of Tesla's Optimus humanoid robot far surpasses products from leading Chinese manufacturers, including Unitree, in body and hand versatility, charging capacity and battery life. Another advantage that American robotics companies have is advanced artificial intelligence capabilities, which will be crucial to developing robots that can learn to perform basic human tasks on their own.

Musk says Tesla's advantage is that it has the engineering capacity to build limbs, artificial intelligence to power brains and the manufacturing know-how to mass produce robots. He projects that the movements of the next generation of Optimus will be indistinguishable from those of humans.

“It's going to look like there's someone like a person dressed as a robot,” he told shareholders this month. “It's really going to be something special.”

His prediction came true recently, in China. Electric vehicle maker XPeng demonstrated its latest robot this month, and its casual gait was so human-like that the company had to convince some skeptics it was a robot by taking heavy scissors on stage to cut away its synthetic skin and reveal its mechanical interior.

By prioritizing commercialization, Chinese manufacturers are leaning on government support and manufacturing prowess to take advantage in the latest frontier of a technological rivalry with the United States, similar to how it came to dominate other industries such as solar panels and electric cars.

“They're not the first at anything. But they're building a lot of robots, selling them very, very cheap, and just trying to get them out into the world,” said Erik Walenza-Slabe, managing partner at Asia Growth Partners, a Shanghai-based consultancy that helps companies expand in Asia. “That might be a better long-term strategy.”

Morgan Stanley estimates that the humanoid robot market will be worth $5 trillion by 2050, by which time China would likely have nearly four times as many humanoid robots in use as the United States. Even as American robot makers like Tesla expand production, their efforts could be hampered by dependence on components that must be sourced from China, such as screws, motors and batteries, the bank's analysts said.

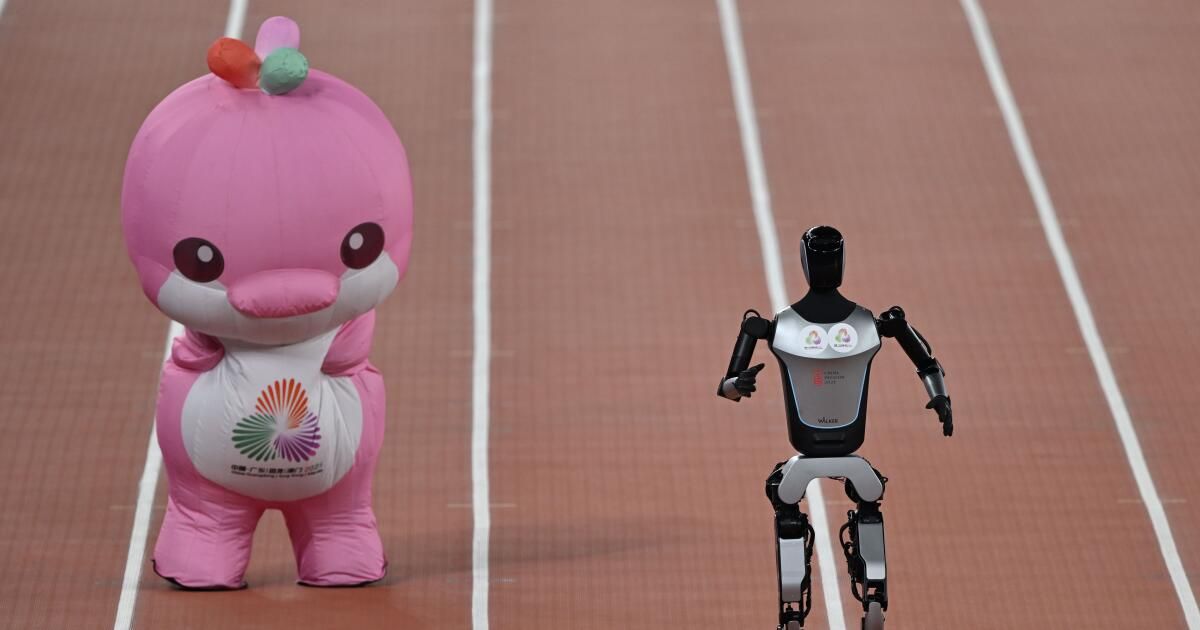

A robot rehearses the 100-meter dash before the opening ceremony of the World Humanoid Robot Games in Beijing in August.

(Ng Han Guan/Associated Press)

While China's massive deployment may help its companies beat the United States in real-world training, public setbacks have highlighted the limitations of Chinese technology and potential risks to human security.

During the first robot half marathon held in Beijing this year, many mechanical competitors fell and overheated and only six of 21 completed the course. Last December, a Unitree robot fell and began convulsing at a demonstration, sparking ridicule online.

Meanwhile, the trade war between China and the United States could impede the development of better robots by both sides.

Both countries have sought to develop and leverage their strengths in high-tech fields. The United States has restricted semiconductor exports to China in an effort to hinder its rival's technological development. Meanwhile, China has a near monopoly on rare earth metals, a critical component in batteries and computer chips, and has tightened export controls to pressure the United States and other nations.

To achieve self-reliance, China has made advanced robotics a key tenet of its national technological and economic development strategy. Earlier this year, China announced a state-backed venture fund to raise and invest $138 billion in robotics and artificial intelligence.

“What China has wanted to do since it entered the robotics game is to circumvent the dominance of traditional technology by foreign suppliers,” said Lian Jye Su, chief Asia AI and robotics analyst at Omdia, a research firm. “The only reason China can do that is because it has political support.”

The lack of similar government policies in the United States could hamper efforts to compete with China, said Susanne Bieller, secretary general of the IFR, particularly as deployment and data become critical to training robots with artificial intelligence.

“In China, the government is encouraging companies to try new technology and that is a critical advantage. That is something that American startups investing in humanoids will have to work much harder for,” he said.