British Airways owner International Airlines Group (IAG) has revealed record annual profits after cashing in on a resurgence in travel demand, including from leisure travelers booking seats in premium economy and business class.

Underlying operating profits for the group, which also includes Iberia, Vueling and Aer Lingus, more than doubled to £3bn by 2023, higher than its pre-pandemic peak in 2019.

Chief executive Luis Gallego downplayed the impact of the UK recession on demand, saying it “remains very strong, particularly in leisure.”

“We don't see any weakness in the market,” he added.

However, the group admitted to BA's poor performance at its London Heathrow hub, where only 60 percent of flights departed or arrived within 15 minutes of schedule during 2023.

“As a result, significant resources have been invested to drive improved performance and some initial initiatives are starting to deliver improvements,” IAG said in its results presentation.

Business travel has been slow to recover, but has been offset by leisure travelers booking premium seats, he said.

Capacity for the final three months of 2023 was at 98.6 percent of levels seen before the pandemic struck in 2019, with full-year capacity at 95.7 percent of those levels. It hopes to increase overall capacity by around 7 percent in 2024.

Gallego said: “In 2023, IAG more than doubled its operating margin and profits compared to 2022… recovering capacity to close to pre-Covid 19 levels in most of its core markets.”

IAG owns British Airways, Iberia, Vueling and Aer Lingus

(PENNSYLVANIA)

He remained tight-lipped about the outlook for airfares this year, saying only that they would be “determined by the market.”

Corporate passenger demand in North America was hit late last year and in the first quarter of 2024 by the Gaza conflict and concerns about instability in the Middle East.

But demand in the US market was showing signs of recovery in the second and third quarters.

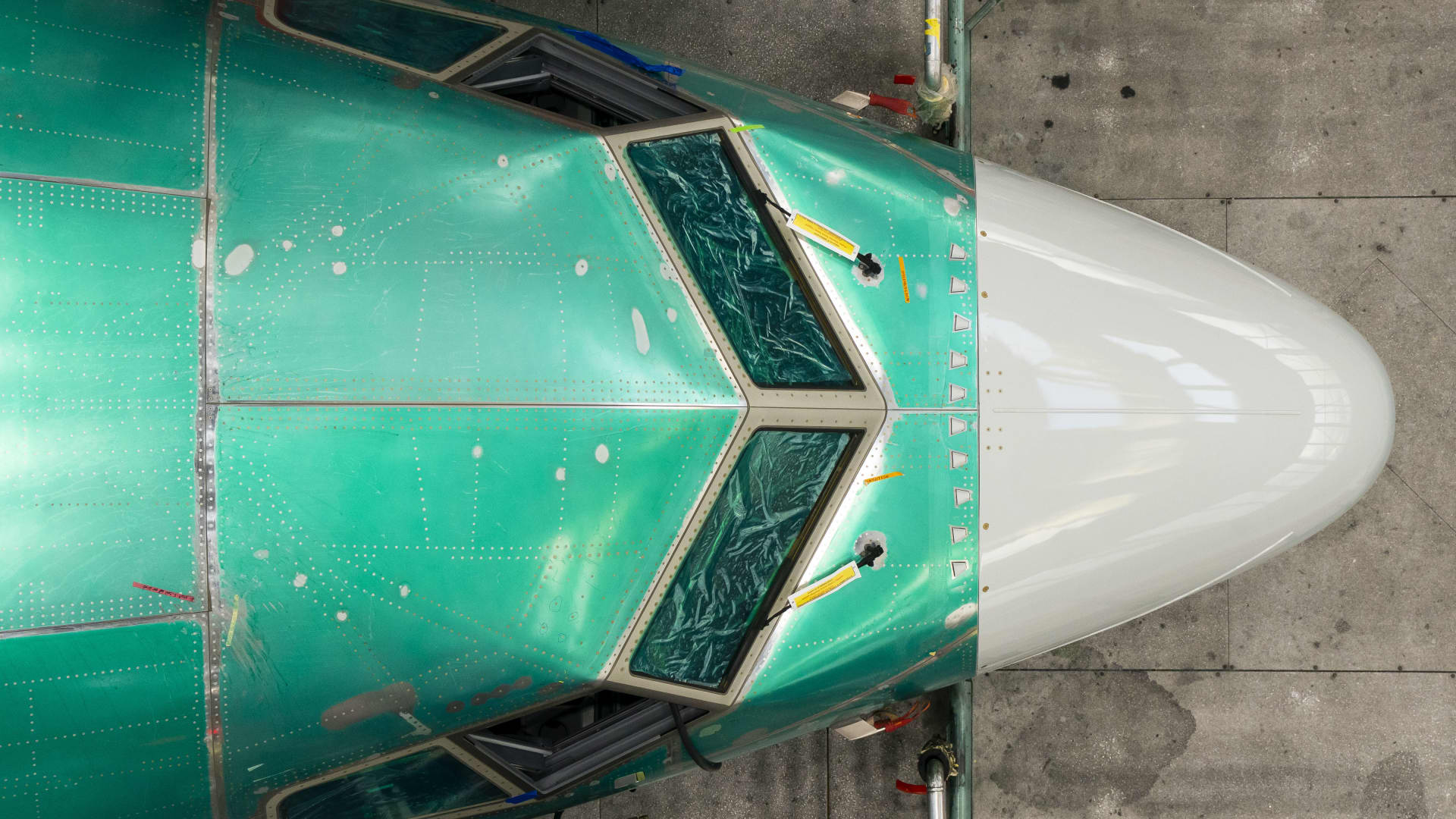

IAG also said it will spend £7bn in total at BA over the next three years in areas such as IT (after a series of systems-related operational failures) and new aircraft.

“British Airways is our biggest asset with enormous potential and that is why we are investing,” Gallego said.

BA's on-time performance at Heathrow improved to almost 80 per cent in January, IAG said, thanks to “integrated planning, ongoing recruitment and training and improved performance management”.

It also said: “A new operating model for London Heathrow will be implemented over the summer.”

IAG Loyalty, its rewards business that oversees its frequent flyer currency, Avios, also posted a record operating profit of £280m, up 17 per cent year-on-year and 59 per cent up on 2019.