The Bank of England kept interest rates at the same level on Thursday but hinted that cuts could soon come later this year after encouraging signs of falling inflation.

Before the announcement, financial markets overwhelmingly predicted that the base rate would remain unchanged at 5.25 percent for the fifth consecutive time.

And they were proven right when eight members of the Monetary Policy Committee (MPC) voted to keep rates unchanged, and the remaining member voted for a decrease.

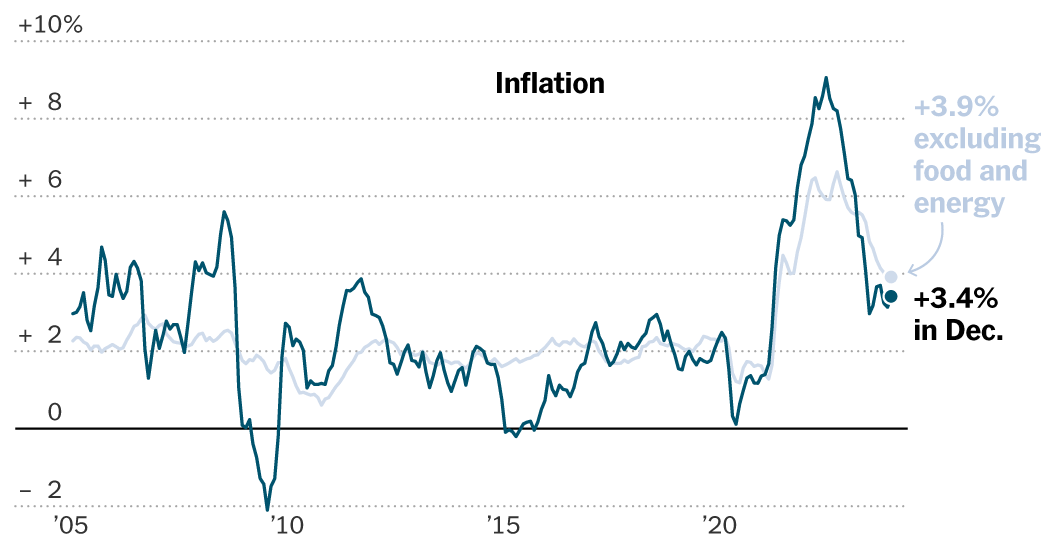

Bank Governor Andrew Bailey said things were “moving in the right direction” after a sharp drop in inflation to 3.4 per cent in February, not far from the Bank of England's target of 2 per cent. .

“In recent weeks we have seen more encouraging signs that inflation is coming down. We kept rates back at 5.25% today because we need to be confident that inflation will fall back to our 2% target and stay there,” Bailey said.

“We are not yet at the point where we can reduce interest rates, but things are going in the right direction.”

Jonathan Haskell and Catherine Mann had argued at the February meeting that rates should rise to 5.5%, but on Thursday they joined the majority in voting in favor of 5.25%.

One committee member, Swati Dhingra, voted to reduce rates to 5 percent, repeating her vote from last month.

Ruth Gregory, deputy chief UK economist at Capital Economics, said: “The Bank of England produced no surprises, leaving interest rates at 5.25% for the fifth time in a row and, despite no MPC members now did not vote to raise interest rates, it maintained its relatively hawkish stance.

“But what counts is the data, not the guidelines. And our forecast that inflation will fall further and faster than the Bank expects suggests it will change its tune in the coming months.

“That's why we think a rate cut is possible in June and why we think rates will fall to 3.00% in 2025 instead of the 3.75-4.00% as priced in the market.”

The Bank of England has attracted criticism from some quarters for raising interest rates too much and being “too cautious” in cutting them given slowing inflation.

Carsten Jung, chief economist at think tank IPPR, said: “Inflation is falling faster than many predicted just a few months ago. This is largely due to the recovery of global supply chains and falling energy costs. But pressures on domestic prices are also falling faster than the Bank had anticipated.

“This all shows that the Bank of England has tightened the screws too much, which is squeezing out much-needed future growth. Therefore, the Bank should cut rates more quickly than its current plans. “The restrictive stance of both the Chancellor and the Bank of England is contributing to UK growth lagging far behind the rapid recovery in the US.”

Suren Thiru, economic director at ICAEW, said: “While interest rates were expected to remain stable again, the split in the more moderate vote and meeting minutes suggest that rate setters are opening the door to interest cuts. rates later this year.

“Although this interest rate hike cycle is firmly in the rearview mirror, the long lag between policy tightening and its impact on the broader economy means that the high cost of 14 rate hikes has yet to fully crystallize.” complete.

“The Bank of England remains overly cautious about the prospect of rate cuts given the striking slowdown in inflation and an economy in recession, raising the risk of prolonging our economic struggles by keeping policy too tight for too long. “.

The real estate industry's reaction was mixed after homeowners previously suffered 14 consecutive interest rate increases in 2022 and the first half of 2023 from 0.1 percent to the current rate, leading to a sharp rise in the mortgages.

Foxtons chief executive Guy Gittins said: “Homebuyers have been patiently waiting for an interest rate cut and while it is expected to arrive this year, it looks like they will have to wait a little longer yet. The positive is that an air of stability has returned to the UK housing market since rates were held at 5.25% last September and this has helped to reinvigorate buyer activity levels in recent months.

And Lomond chief executive Ed Phillips commented: “Having previously endured 14 consecutive base rate increases since December 2021, it has been a non-event, it is good news for the country's homebuyers in recent times. when it comes to the Bank of England's decision on interest rates. .

“That said, you can be forgiven for feeling a little disappointed that we haven't seen a cut materialize today, particularly given this week's inflation figures.”