Your support helps us tell the story.

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether it's $5 or $50, every contribution counts.

Support us to do journalism without an agenda.

Bank of England Governor Andrew Bailey has said interest rate cuts could soon become “more aggressive”, causing the value of the pound to fall.

Bailey said the Bank could become “more activist” in its approach to borrowing costs if recent positive inflation trends continue.

The comments mark a departure from his previous approach, when he said rates would only be reduced gradually. Shortly after his comments today, the pound fell almost one percent against the dollar and euro.

The Bank cut rates from 5 percent to 5.25 in August, the first reduction since March 2020, after inflation returned to the 2 percent target. Although the figure has since risen again to 2.2 percent, experts have predicted another interest rate cut before the end of the year.

The Bank is expected to cut rates next month by another quarter of a percentage point to 4.75 percent, but Kathleen Brooks, director of research at XTB, said that in light of Bailey's comments, financial markets will also They now see a 61 percent chance of another reduction. in December.

“The market has used Mr. Bailey's comments as a green light to price in further monetary easing,” he said.

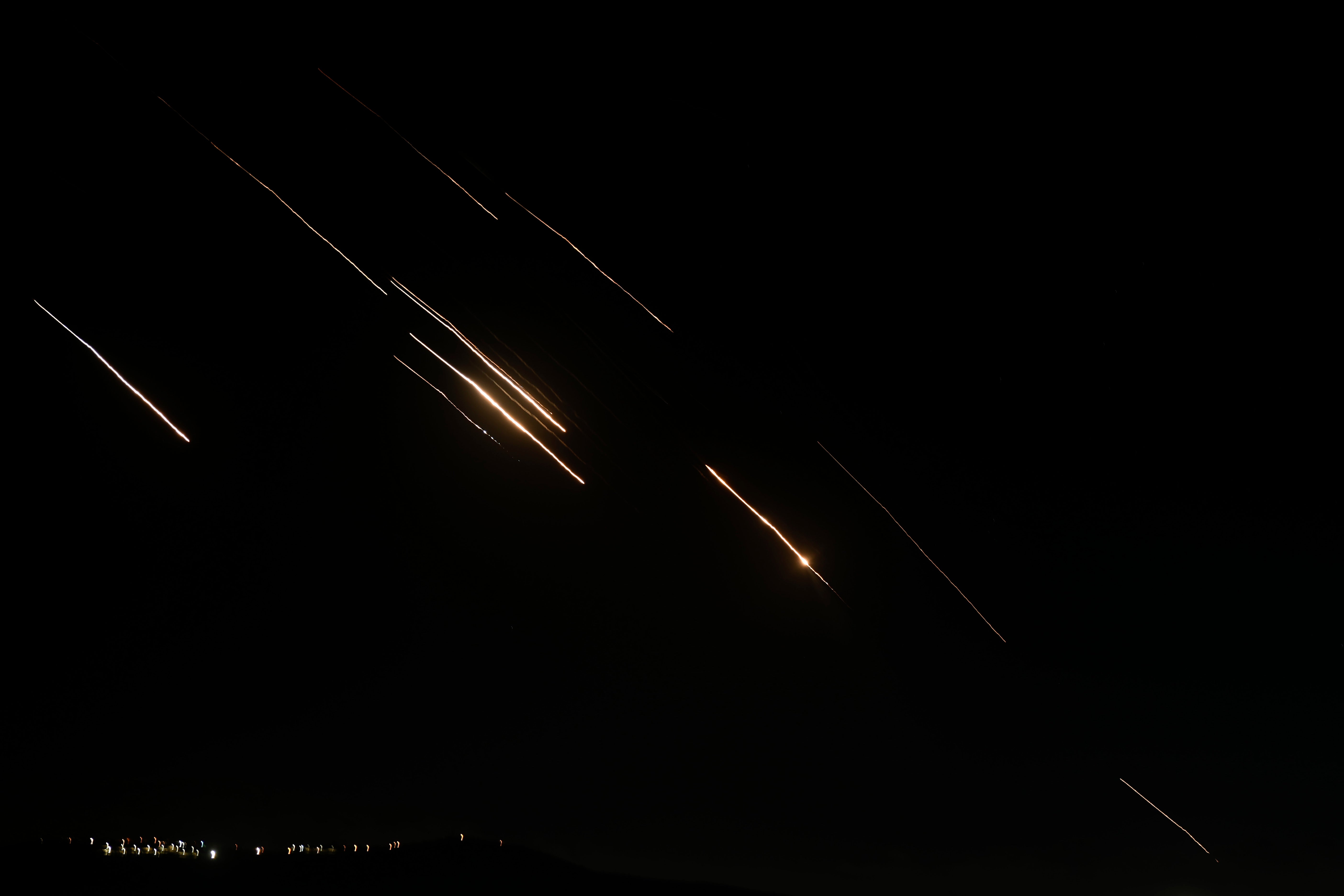

Bailey also said the Bank is following “extremely closely” developments in the Middle East amid sharp increases in the cost of oil, which soared this week after the Israeli invasion of southern Lebanon and Iran's missile attack. against Israel.

He said: “The geopolitical concerns are very serious,” adding: “What is happening is tragic.

“There are obviously tensions and the real issue then is how they might interact with some markets that are still quite tense in some places.”

A report from the Bank's Financial Policy Committee (FPC) on October 2 warned that global financial markets are vulnerable to crises following an “increased volatility” over the summer amid uncertainty over the geopolitical situation across the globe. world.

But Bailey said oil prices have not seen the impressive increases of last year since the Hamas attack on Israel.

He said: “From a monetary policy point of view, it is a great help that we have not had to deal with a big increase in the price of oil.

“But obviously we've had that experience in the past, and in the 1970s the price of oil was a big part of the story.

“Obviously we continue to see it. We follow it very closely to see the impact of the latest news.”

He warned that while markets remain stable, “there is also recognition that there is a point beyond which that control could collapse if things get really bad.”