With a parade of new models and a marketing push from Formula 1, sports car maker Aston Martin expects to be cash flow positive this year, according to Chief Executive Lawrence Stroll.

“We're really in a moment of transition now, with an inflection point for this company,” Stroll told CNBC. “We are introducing all of our products, finally, after designing and building them for the last four years, after I took over. Going forward, we will now have a normal quarterly production, not these hockey sticks that we have seen in the past. , but the more traditional quarterly flow of new vehicles constantly coming to market.”

Stroll said the company, which has been losing money for years, expects to be cash flow positive starting in the third quarter and continuing that way into the fourth quarter and beyond.

That would mark a dramatic change for the storied British carmaker, famous as much for its role in the James Bond films as for its history of financial ups and downs. Stroll, a billionaire former fashion mogul who took over as chief executive of Aston Martin in 2020, imposed a radical plan to restore the brand's luster and profits.

Aston Martin has revamped and improved manufacturing, shored up its finances for future investments and is now launching a fleet of new products defined by luxury finishes and high performance.

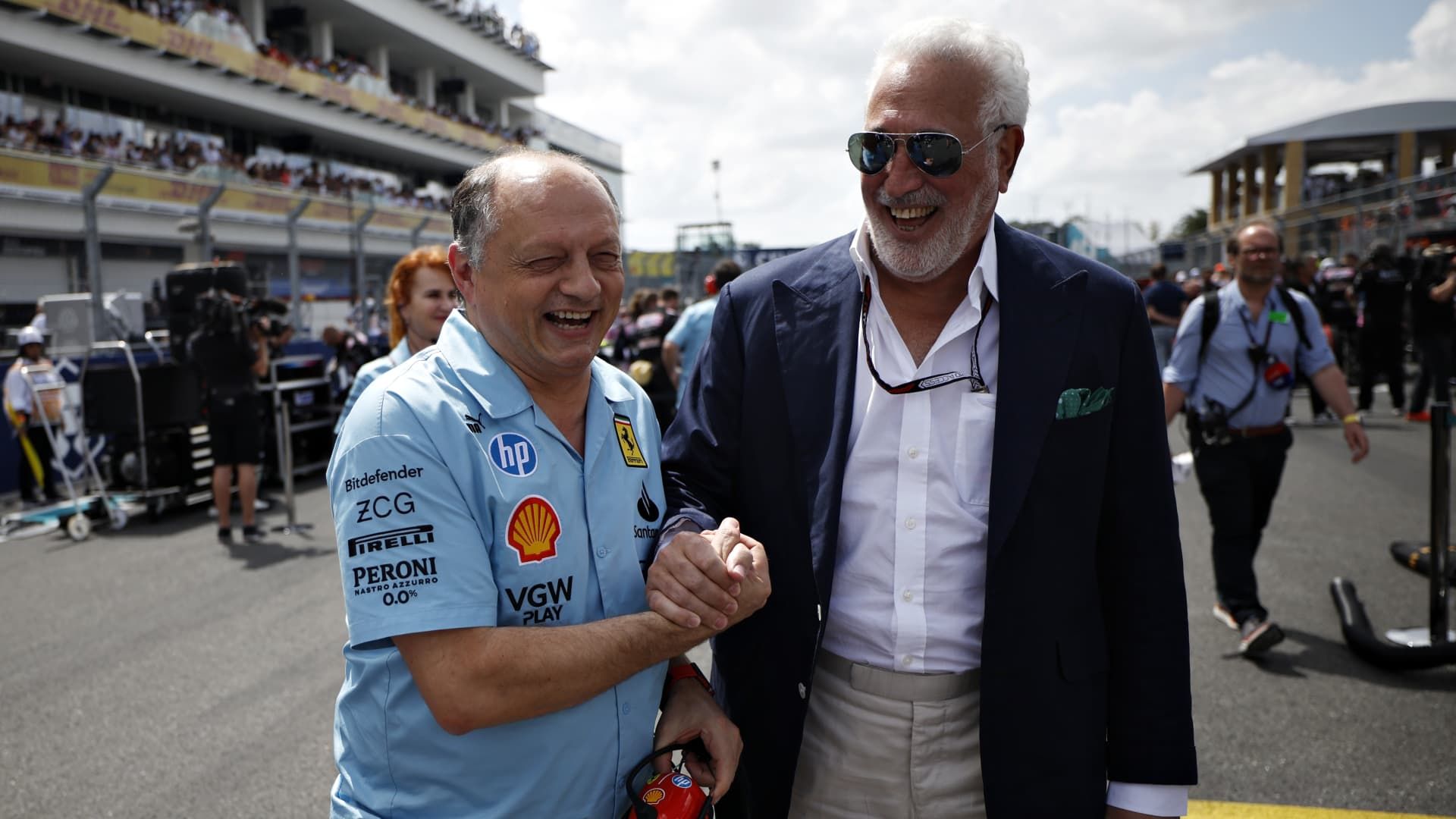

Aston Martin F1 team owner Lawrence Stroll (R) shakes hands with Ferrari team principal Frederic Vasseur on the grid before the Miami F1 Grand Prix at the Miami International Autodrom on May 5, 2024 in Miami, Florida.

Chris Graythen | fake images

Still, production fell and pretax losses doubled in the first quarter compared to a year earlier, sending the company's stock to its lowest level since 2022. Stroll said the drop in production and an expected drop in the second quarter are part of an intentional plan. to phase out older models and make room for the list of new models to increase in the coming months.

“We have made a conscious decision to stop all production” of certain models,” he said. “We have reduced wholesale manufacturing volume so as not to accumulate older cars in dealer networks while we launch all our brands. “new vehicles.”

The new vehicles include the new Vantage, a front-engine, rear-wheel drive sports car with 656 horsepower and a starting price of $191,000.

The automaker also introduced the new DBX707, its high-powered SUV, which can accelerate from 0 to 60 mph in 3.1 seconds and top out at 200 mph. The company has also introduced a convertible version of its DB12, called the DB12 Volante.

Aston Martin has shown off a new super-powerful V-12, expected to be called Vanquish, later this year.

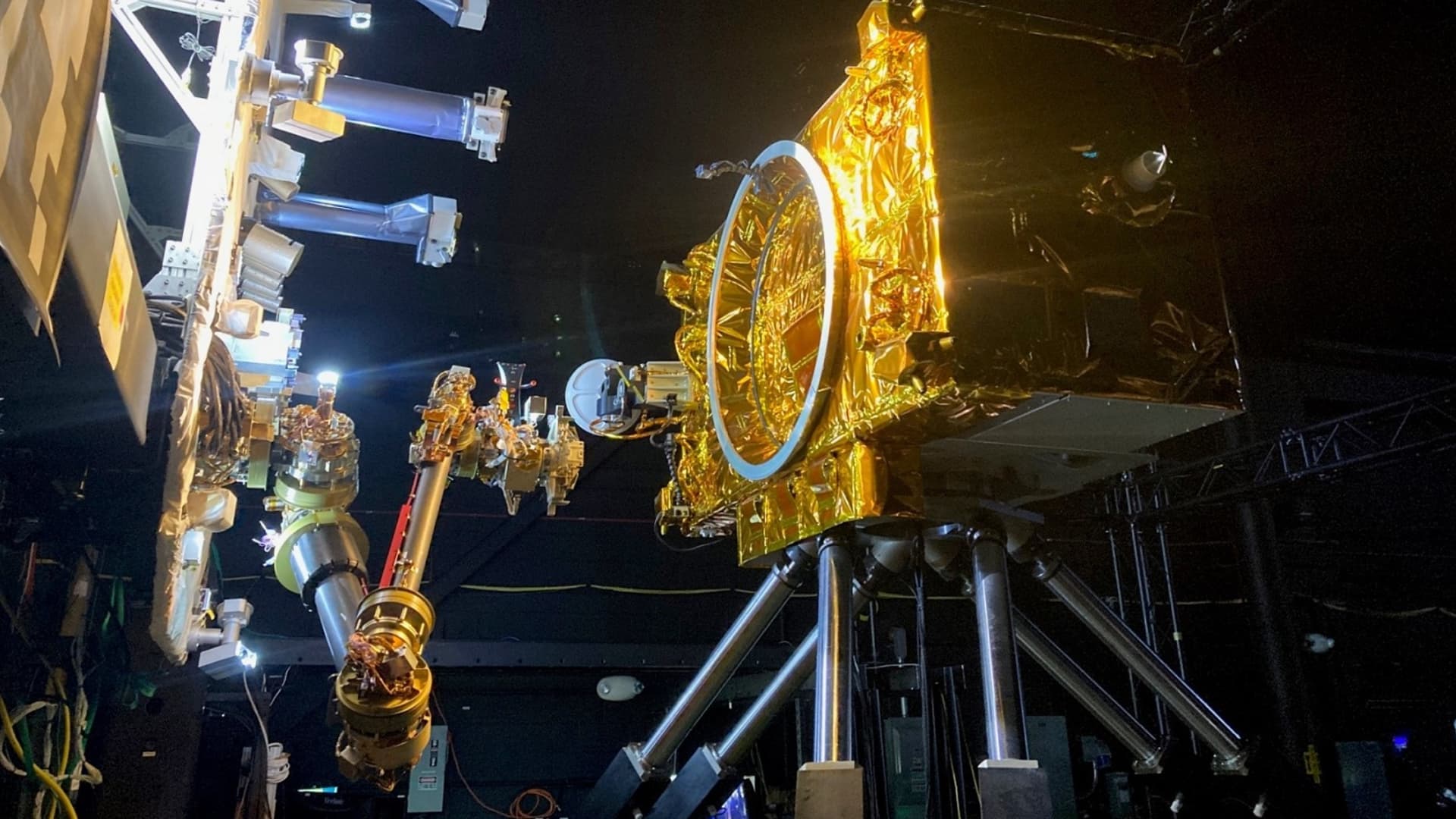

It is also expected to begin deliveries of its $800,000 hybrid supercar, called Valhalla, later this year or early 2025.

Aston Martin's Valhalla hybrid, valued at $800,000.

Courtesy: Aston Martin

Along with the new models, Aston Martin is committed to continuing to grow from its customization program. A year after opening its “Q New York” showroom, which allows customers to customize their cars with their own paint colors, interior fabrics, stitching and other details, the company is planning Q locations in London, Miami and California .

Stroll said some customers are paying an additional $100,000 to $200,000 beyond the sticker price of their cars for highly specialized customization. One customer even requested fur for the interior, she said.

The personalization program has helped increase the average selling price of an Aston Martin by 35% in the last two years, to $294,0000.

“It's really been a home run,” Stroll said. “Not only from a financial point of view. People come [to Q New York] and they understand what Aston Martin is all about. They say, 'Okay, I understand.' You know, it's the show, it's the feeling.”

Aston Martin is also attracting a younger buyer, thanks in large part to its Stroll-owned Formula 1 team. Stroll said the average age of an Aston Martin customer is now 42, up from 55 four years ago.

“The brand is really booming and a lot of that has to do with Formula 1,” he said. “Being in Formula 1 for the last three years has really significantly rejuvenated the brand, and also our whole new product portfolio.”

Stroll has dismissed reports that he is looking to sell a minority stake in the Aston Martin Formula 1 team to help finance the car company.

“We don't need to raise capital at all,” he said. “When you start manufacturing 8,000, 9,000 vehicles [a year], our cash flow is extremely positive. … So no, there is no interest or requirement to raise more.

On the future of the company's electric vehicles, Stroll said the company is delaying the launch of an all-electric Aston Martin from 2025 to 2026. The company has designed four electric vehicles based on the same platform, but customers of Aston Martin do not show enough demand.

“We don't want to swim against the current,” he said. “Our consumer, at least the Aston Martin customer, the high-performance customer, is telling us that we are not ready for an electric vehicle, at least not from us. So we hear it loud and clear.”