Truly support

independent journalism

Our mission is to provide unbiased, fact-based reporting that holds the powerful to account and exposes the truth.

Whether it's $5 or $50, every contribution counts.

Support us in offering journalism without agenda.

The UK economy grew faster than expected in May, but this could lead to a further delay in interest rate cuts by the Bank of England, dealing another blow to borrowers.

The Office for National Statistics said gross domestic product rose 0.4 percent in May, beating forecasts for 0.2 percent growth, as more shoppers returned to high streets and construction work picked up.

This came after growth was flat in April as wet weather dampened consumer spending.

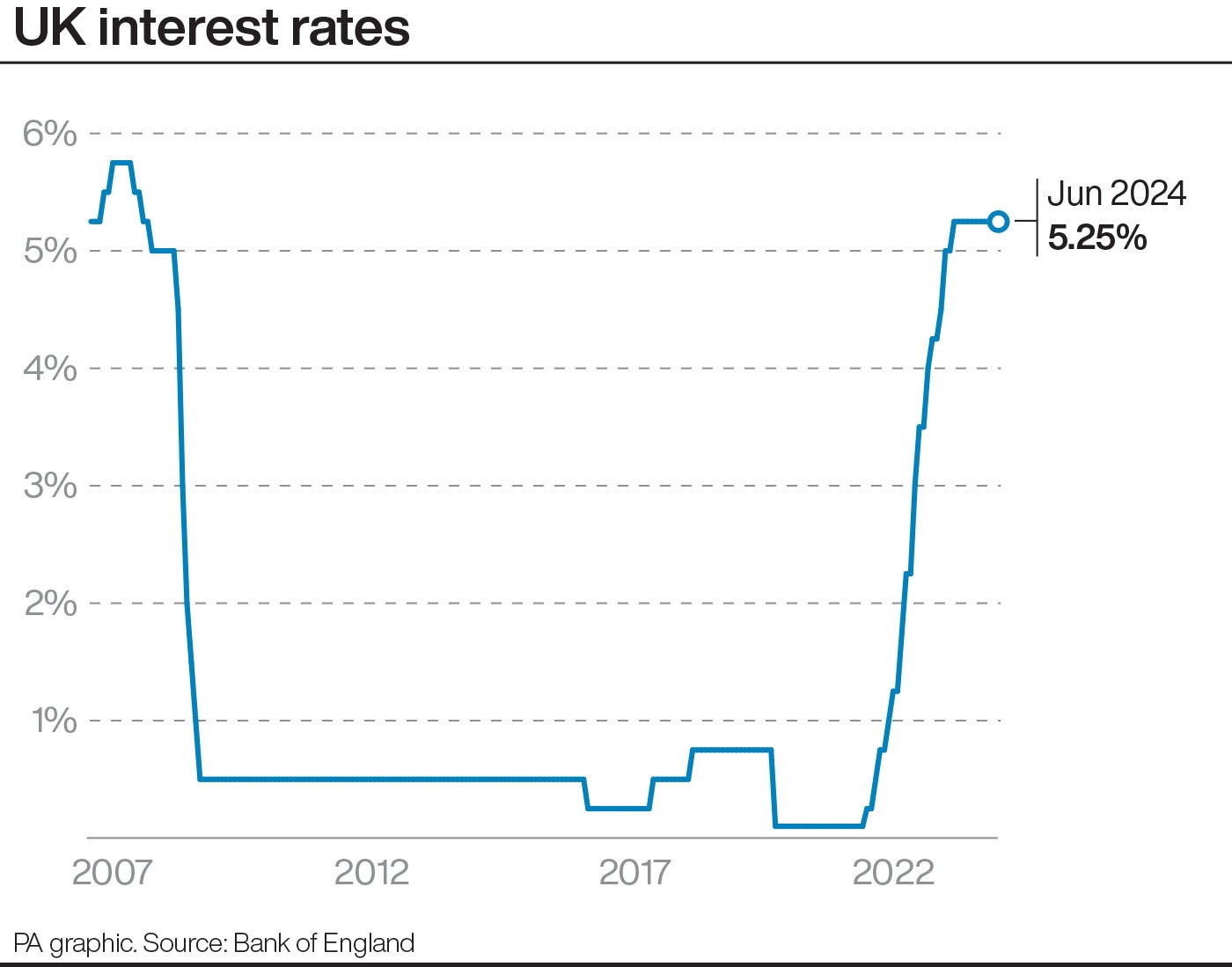

However, a more positive economic outlook and inflation concerns could convince Threadneedle Street policymakers to leave interest rates unchanged when they meet again in August.

Suren Thiru, economics director at the Institute of Chartered Certified Accountants (ICAEW), said: “These figures confirm a solid rebound in economic activity, as increased services and construction output helped the economy return to growth.

“May’s GDP rebound may well have been followed by a poor June, with wet weather likely to have stifled output in key sectors of the economy, despite support provided to hospitality and some retailers in the run-up to Euro 2024.

“In the longer term, the new government faces an uphill struggle to achieve its ambition to significantly improve the UK’s growth trajectory unless it can substantially boost productivity and tackle economic slack.

“These GDP figures may make an August rate cut less likely by giving rate-setters, who are concerned about underlying price pressures, enough confidence in the UK economic recovery to continue postponing policy easing.”

Ashley Webb, a UK economist at Capital Economics, said the stronger-than-expected GDP forecast meant the Bank did not need to rush to cut interest rates.

He said: “We still believe the Bank will cut interest rates from 5.25 percent to 5.00 percent at its next policy meeting in August, although the timing of the first cut will be heavily influenced by June inflation and May labour market data due next week.”

The economy stagnated in April after a 0.4 percent monthly increase in March due to wetter weather, according to the Office for National Statistics.

Growth was driven entirely by the services sector, with rapid expansion in the information technology and professional and scientific sectors.

Between January and March, UK GDP grew by 0.7 percent. This growth allowed the British economy to recover from a recession in the second half of 2023.

ONS director of economic statistics Liz McKeown said: “The economy grew strongly in May, with all major sectors seeing increases.

“Many retailers and wholesalers had a strong month, both rebounding from a weak April. Construction grew at its fastest pace in nearly a year after recent weakness, with housing starts and infrastructure projects boosting the industry.”

In June, inflation also fell back to the 2 percent target for the first time in nearly three years. Figures from the National Bureau of Statistics show that the consumer price index (CPI) fell to 2 percent in May, down from 2.3 percent in April.

The new figure marked the first time inflation had been on target for the Bank of England since July 2021, before the cost of living crisis sent inflation soaring, at one point reaching levels not seen in 40 years.

In the first week since Labour's landslide election victory, Chancellor Rachel Reeves has pledged to revive the economy by making it the new government's “national mission” to secure the fastest sustained growth in the G7.

Ms Reeves said: “Achieving economic growth is our national mission and we have not a minute to waste.

“That is why I have already taken the urgent steps needed this week to put our economy back on its feet, rebuild Britain and improve the situation in every corner of it. A decade of national renewal has begun and we are only just getting started.”